Ali Capper, executive chair of BAPL, shares her response to the October 2024 Budget announcements

Has the government fully considered the consequences of its recent budget decisions? The price of home-grown food will rise. Home-grown food production will fall. Climate change means imports are a less viable solution.

Let me explain …

There’s a mantra I’ve heard time and again from Whitehall in the last decade: “We are a rich first-world economy, we do not need to farm and grow food, we can import it from wherever we want.”

This is largely true. We can import food, and the imported food is often cheaper than home-grown produce. Imported food also offers more choice. We can’t grow bananas and oranges here, for example, in our maritime climate. That all sounds great – cheap food, whatever we want, whenever we want. But why is it cheaper? Because it is produced with less regulation, lower labour costs and a lot more pesticides.

And what if the country we’re importing from can’t supply us with the food we want? Wars, adverse weather, strikes and pests all impact the production and transportation of food imports to the UK. If we rely on imports, we are very vulnerable to a range of risks that could completely stop supply.

That’s why farm subsidies were introduced decades ago. To support farmers and growers in first world economies to continue production and enable them to compete with cheaper imports and secure supply if those imports ran short.

Today, there is an even more pressing reason why we cannot rely on imports – climate change.

In 2023, the UK imported £7,140m worth of fruit and vegetables in 2023 of which £486.5m came from Spain.

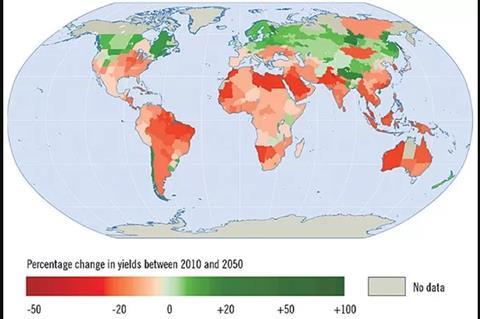

Look at Spain on this World Bank map below (map source) – it’s in pink. That means crop yields – including how much fruit they produce – will decrease between 2010 and 2050 because of higher temperatures, lack of water or adverse weather events.

On the same map, the UK is in green. That means the UK will remain a good place to grow food.

Climate change will reduce our import options – and make what we can import more expensive. A clear argument for supporting home-grown produce. Not just to feed our nation, but potentially to export to countries who, because of climate change, are going to struggle to feed their people.

However, successive governments seem unconcerned. In fact, their policies will drive up the cost of British food and make food supply less resilient and more dependent on imports.

The recent budget included news that the cost of labour at national living wage will increase by 6.8% in April 2025. Adding together the increases in the national living wage, national insurance and sickness pay benefits will take the wage increase to over 10% for the year. For a fruit business, where the labour cost is 40% of turnover, that is going to create significant food inflation.

But there’s more …

The new inheritance tax (IHT) rules will damage family fruit farms. Many farms own the land that their orchards are planted on, and many will be farming 200+ acres. The new £1m IHT threshold will create a tax bill of at least £750,000 for a 250-acre fruit farm with buildings and some property.

At the very least, that will increase the price of food. At worst, families will be forced to sell their farms to pay the tax bill. Farms do have large assets, but they are cash poor, they tend to make low profits and often make losses. Weather can reduce turnover by 20-30 per cent in a year and that loss cannot be insured.

I sympathise with the government’s desire to prevent the rich in society from using inheritance tax rules to pass on their wealth tax free, but Agricultural Relief on IHT was designed to protect farmland and food prices. This week’s initiative needs to be reconsidered.

Some farm businesses may be able to mitigate the tax by “gifting” the land to the next generation. That is if that older generation lives for more than seven years after the gift. But today many farms are owned by people much older than that, who may not live another seven years, and, in that situation, the farm would very likely have to sell land to pay the tax bill. That will put the next generation of farmers leading those businesses either out of farming altogether or farming a smaller area, making their businesses less efficient and threatening the livelihoods of their staff, subcontractors and suppliers.

Why can’t the farm afford to pay the tax bill? Low profit margins. Why doesn’t the farmer put the land in trust to protect it? The business cannot borrow money if the land is held in trust. The “forestalling clause” means that the change will come into effect on 30th October 2024 for transfers. Is borrowing an option? It maybe for some, but the farm business will have to be able to fund the repayments. Many will be unable to do this.

Defra may be making proud announcements that the agriculture budget has been protected but look at the detail and you’ll see more bad news for British farmers – a reduction in the BPS rural assistance payments (an historic subsidy) and a new fertiliser tax from 2027.

I think British people want a secure supply of British food that is affordable. I think they are rightly concerned about climate change and the impact that could have on food imports and food security.

Sadly, the government isn’t listening.