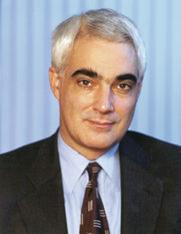

Chancellor Alistair Darling’s Pre-Budget Report released on Monday has sparked mixed responses from across the food and retail industry.

The National Farmers’ Union (NFU) said the report was “of limited value” in helping agriculture play its part in driving forward an economic recovery.

The package, which includes a comprehensive set of measures designed to boost short-term household income, spending and business, contains a number of welcome provisions, said the NFU - however, “it by and large bypasses the measures that would have set farming in good stead during a downturn”.

NFU president Peter Kendall said: “Our acid test for the pre-budget report is whether it will overall boost the competitiveness of UK agriculture and the agri-food sector. We will need to study the detail carefully, but overall we would find it hard to come to this conclusion. Still, there are a number of commendable parts to the Chancellor's statement, together with some matters of concern but several missed opportunities. It is good to see government as a whole focusing on how it can boost small- and medium-sized enterprises (SMEs) as a cornerstone to economic recovery.”

Proposals for a temporary tax relief on vacant property to delay the payment of tax bills, to introduce a substantial small business finance scheme and to allow SMEs to offset losses against profits made in the past three years were welcomed by the NFU, said Kendall.

“On the other hand, we are concerned that an increase in employers’ national insurance contributions by 0.5 per cent from April 2011 could adversely impact on competitiveness,” he added.

The British Retail Consortium (BRC) has described Darling’s decision to reduce the basic rate of VAT by 2.5 per cent from 17.5 to 15 per cent as “modest but welcome” - although implementing a new VAT rate in just one week will be “exceptionally difficult” for shops at their busiest time of year, said the body.

But the Chancellor’s move to increase duty on fuel to offset the VAT cut has been condemned by the Freight Transport Association (FTA) as “a cynical and disgraceful targeting of commercial vehicle operators to help fund his other tax give-aways”.

James Hookham, FTA’s director of policy, said: “By offsetting the reduction in VAT with an increase in fuel duty, [Darling] has added thousands to the transport bills of companies across every sector. Not only does this hurt businesses directly, it also hurts the consumer, who will end up paying more to cover transport costs of items such as food, clothing and white goods. Christmas suddenly got even more expensive.

“As far as the logistics sector is concerned, the Chancellor is giving with one hand and taking away with the other.”

And the Association of Convenience Stores (ACS) has expressed disappointment that the Chancellor did not go further in reducing the cost burden on retailers. ACS public affairs director Shane Brennan said: “We welcome a number of the measures targeted at small businesses in particular. However, for the retail industry, the Pre-Budget missed the opportunity to make a radical difference to the financial pressures on the industry.

“We made clear to the Chancellor that the best way to help the retail sector is to postpone increases in business rates next year, and also to urgently review plans for implementation of the 2010 revaluation. These two planned rate increases have the potential to put the most pressure on convenience retailers.”