The last time the FPJ went knocking on Jonathan Olins door, in early 2003, he was in control of a £10 million specialist supplier of Class I fresh fruit to the non-supermarket sectors. “I am not chasing turnover,” he said then. “And I will turn away produce if it doesn’t help our cause.” He has stuck to his word, and enhanced the customer-driven approach so unusual in non-supermarket suppliers. Because of that, turnover has almost inevitably chased him.

Poupart Imports will sell in excess of £15m of product in 2005, having moved to £11.5m in 2004, and the main driver of this growth has been business carried out throughout the food service sector and in particular the wholesale markets. This is especially so in London, which represents around 40 per cent of overall turnover. Sales into the capital’s three biggest wholesale markets have risen by 79 per cent (New Covent Garden), 81 per cent (New Spitalfields) and 109 per cent (Western International) year-on-year, and that on the back of healthy rises in all three in the previous year. While the markets are bouncing back, they are not achieving growth in that stratosphere, so the inescapable conclusion is that Poupart is taking market share from its competitors.

Financial analysis has never been the strongest string to the non-supermarket sector’s bow, but Poupart holds monthly management meetings to assess its performance with all customers, in all regions. It is therefore aware that, although its London sales have risen dramatically, there are various parts of the UK that are underperforming relatively. “We look at these figures as a team, with a view that we want to be strong in all these markets, and eliminate any apparent weaknesses,” says Olins. “I think we are rare in the way we analyse our business, and it is a discipline which has been transferred from the group’s supermarket business.”

The positives in that anlaysis far outweigh the negatives, and Olins identifies three major drivers behind the growth; the procurement of consistently high-quality produce, a reliable distribution service and - top of his list - a team of people recruited specifically for the task in hand. “The industry has split, and the skill bases and disciplines needed to supply the supermarkets and the non-supermarket sectors are totally separate,” says Olins. “We have created a team to deal specifically with the foodservice sector, as opposed to having the skill-base to handle supermarket accounts.

A sales team of six has brought its vast experience to bear. “All of us enjoy the one-to-one relationships with our customers and we are committed to creating opportunities and solving issues together with them. We were all brought up through the wholesale markets and we have a feel and understanding for our customers that has been crucial to our success so far,” says Olins.

“The speed of our growth has been incredible, not just of the customers we have been able to bolt on, but also of the supplier base. It does not happen overnight, you have to be able to guarantee security and consistency before people jump on board, but this is undoubtedly one of our strengths as part of a bigger group.” In fact Olins’ division represents just 10 per cent of the total Poupart Group turnover.

Another strength is the technical team that ensures that Poupart adheres to the heightening standards expected of its products. “Full traceability is more widely demanded and that is no issue for us and increasingly our customers are saying that if we cannot meet their specifications, they won’t take our products. For smaller companies, that can be a major problem; they can find it difficult to move up a level, but we have everything in place,” Olins says.

The team is on the verge of being strengthened, as a seventh salesperson is being sought, to be based in the Spanish trading office.

The products that the company can deliver run its staff a very close second in terms of importance. Poupart delivers to customers in every wholesale market in the UK every morning of the year, building its base by transforming itself into a year-round source for selected fruit lines. Around 120 carefully selected companies, both inside and outside of the wholesale markets, now make up the customer portfolio. “We have constantly been filling the gaps over the last three years and that has led to us holding onto our customers - we don’t lose them, we work with them 52-weeks a year and every time we have bolted on another product it has made life easier for us and them.”

Additionally, there is business direct with some of the bigger independent retailers and foodservice companies, as well as top-up deliveries to supermarket service providers. “We have all the protocols in place to be able to conform with supermarket requirements, and at certain times of year we always know there will be top-up business around, but we never deal with the supermarkets themselves.”

Ron Castledine’s appointment made a big difference. Within 12 months, Poupart had added not just the top-fruit that previously came into the UK through Castledine’s Perpignan-based company, but his multilingual abilities has seen him clocking up the miles through southern Europe to secure new and complementary sources and lines, such as grapes from southern Italy and South Tyrolean apples. “Some of these sources developed out of necessity with the way the seasons were last year,” says Olins, “but once the customers saw the potential of the fruit being brought in and the suppliers became aware that this business could be profitable, the supply base has become established.”

Castledine’s endeavours mirror the way Poupart has developed a significant business across all categories of fruit from Chile in less than three years, and - while a fruit specialist essentially - found itself a year-round supply network for asparagus. “We see ourselves 99 per cent as a fruit firm,” says Olins. “And that will remain our primary focus, as we fill in the few gaps we have left in the calendar. But three or five years down the line, our business might be different. It takes time to develop supply sources and already our decisions to extend our portfolio have shown us the importance of having back up for all lines. Any company has to find the right partners and it is important to be selective of the areas you choose to develop.”

While some growers and suppliers might prefer the apparent solidity of a pre-determined programme and price, experience illustrates that paper returns do not always translate into hard cash. The ability of Poupart to use its 12-month global supply network to ride the waves of the dynamic wholesale and foodservice sector prices and emerge with a sound end-of-season financial performance for its suppliers more than justifies the perceived risk of selling into an ostensibly open market. “We know of course that prices are not guaranteed on a week-to-week basis, but we are able to maximise returns for growers that send us the quality of product we need for our customers,” says Olins.

“We have looked to build 12-month availability in our key lines because we need certainty from start to finish; we can’t chase the market. At the end of any given season, you can be sure that there will be some ups and downs on the graph, but when it is all evened out, we can compete with supermarket returns. While we only take top-quality fruit, we do not necessarily cherry-pick on sizes, as different elements of our customer base can take the whole range.”

It will surprise many readers, and Olins does not mind admitting that it has surprised even him at times, that the returns to growers provided by Poupart often outstrip those achievable by suppliers to supermarkets. “Some of our shippers are also supermarket suppliers and some supply 80 per cent - if not more - of their fruit to the multiple retailers. They are using me as a direct route into the non-supermarket sector and we are coming out very favourably when our returns are compared with those of the supermarket suppliers.”

There are other factors that must come into play here. While the supermarkets, for instance, have largely exorcised brands from their shelves in recent years - although there appears to be a change of heart taking place now - the possession of a well-marketed, reliable brand has never lost its caché in other sectors. “We have a large number of exclusive brands under our control now and we’re in a position to maximise their potential,” says Olins. Although brands do not necessarily equate to premiums, what they can do is create a following that implants a degree of balance in the demand curve.

Distribution is third on Olins list of drivers. “We have seen a big increase in our business in Glasgow, for instance, and a big part of that is the reliability of the distribution service. If they are getting the product they want, and they can rely on deliveries arriving on time, every time, customers will keep coming back.”

Poupart uses Dartford-based Fresh Services as its distribution specialist. The business fit is ideal, Fresh Services does not supply into the supermarket sectors either and it has extensive knowledge of the fresh produce industry. “We want our service to offer customers not just the best supplier, but also the best distributor,” says Olins. “Fresh Service gives us a unique location for international arrivals and distribution, it has recently invested upwards of £1m in its facilities, which incorporate comprehensive chilled warehousing and loading bays. It has an on-site QA team, 24-hour offices manned by excellent customer service employees and like us, it treats our customers with the respect they deserve.”

Wholesale traders, in particular, will be all too aware of the frustrations of turning up for work in the middle of the night only to find that the product they are there to sell are nowhere to be seen for no apparent reason. Fresh Services prides itself on the timeliness of its deliveries, says Olins, and in the event of delays, will always contact the customer to explain the situation. “The whole job can fall down if we don’t deliver and we have to be assured that every package is being looked after at every stage. Wholesale market and foodservice customers are just as entitled to punish you as supermarket customers.”

The obvious final question for Olins to answer is what is next? He is definite. “We have to further exploit the many advantages we have. The more volume we can pull through the existing team, the more profitable we can become. There are still some product gaps left to be filled in our supply calendar and we intend to do that in a way that benefits all parts of the chain, creating a virtuous circle.”

While a large part of the Poupart turnover is garnered from customers operating outside of the wholesale markets, he recognises the role the sector has played in his company’s development. “Of course, we wouldn’t be doing this if the UK wholesale markets hadn’t stabilised and become more financially sustainable. All of our clients, with the exception of about two per cent, are fully indemnified by our insurers. The profitability is there in the wholesale sector, contrary to widespread opinion, it has not been drained away. If it had been, we wouldn’t have a client base to speak of in the markets.”

Poupart does not claim to be unique, but it can justifiably label itself unusual in its direction. No doubt, its customers and customers of like-minded companies would concur that the return to solidity of the wholesale markets has been assisted by better supplier understanding of the needs and aspirations that exist within them.

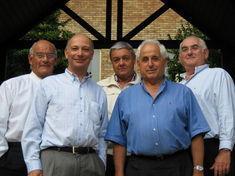

JONATHAN OLINS

Olins is third generation in the fruit industry, with 30 years experience in the trade. After five years as a salesman in the wholesale markets, he became an importer/distributor concentrating on non-supermarket clients. He particularly specialises in procuring a wide range of products from South Africa and South and Central America.

STEWART ABBEY

Abbey has been importing fruit for 38 years. He initially worked in the wholesale markets, before progressing to trade citrus in the supermarket sector with J I Emanuel. He has been involved in Poupart’s import business for eight years, with the last two of those spent solely serving the general trade.

PHILIP EMANUAL

Emanuel is the fourth generation of his family in the fruit industry, with 46 years of experience. The first 44 of those years were spent in Covent Garden, old and new, where he was chairman of the tenants association for 13 and a half years. He switched to the “other side of the fence” with Poupart in 2004, where he has used his vast knowledge to develop the company’s new European trading business from its Epsom office.

PAUL EMANUEL

Emanuel is also fourth generation in the fruit industry, with 42 years of experience. He sold his family business, JI Emanuel to Poupart in 1997 having been managing director since 1983, when he decided the economies of scale required by his supermarket customers were not realistic within his company’s existing structure. He started his career importing and marketing to supermarkets in Covent Garden and now concentrates on leading Poupart’s sales drive to its non-supermarket client base.

RON CASTLEDINE

Castledine has been in the fruit trade since 1965, when he began as a salesman in London’s wholesale markets. He then learnt Spanish, Italian, French and German and his linguistic expertise has shaped his career. After working in Germany for a UK importer, he set up his own export firm in Perpignan, selling apples to the UK. He joined Poupart in 2004 to develop the company’s fruit business out of Europe and is based in Figueres, Spain.

RICHARD EMANUEL

The youngest member of the Poupart team, Richard Emanuel is fifth generation in the fruit business and has seven years experience, which have encompassed buying in New Covent Garden and a period importing exotics. He now focuses on sales to the wholesale sector.