Production levels of fruits and vegetables worldwide have been growing at a rate of 3.4 per cent annually, surpassing consumer demand in terms of volume.

As a result, many producers are forced to look for new markets, either in terms of new export countries or new added value products.

At the same time consumers require a wider choice of products, available year-round and preferably in a fresh and convenient format. As a result, fruit and veg, either processed or fresh, is shipped all over the globe and trade is increasing.

Global annual production of fruit and veg (excluding potatoes) amounts to over 1.3 billion tonnes and has grown at the rate of 3.4 per cent CAGR (compound annual growth rate) over the last decade.

Interestingly enough, the production of vegetables has grown at a much faster rate (5.1 per cent) than fruit (2.1 per cent) and currently the volume of vegetable production is almost twice that of fruits. This relates to the fact that vegetable production has become more efficient: production growth in terms of volume has outpaced the increase in acreage. Growth in fruit production in terms of volume is in line with the increase in acreage.

The world’s major crops concern tomatoes, followed by citrus fruit and watermelons. Vegetables are more fragmented, the five major vegetables crops accounting for 43 per cent of total vegetables, while the five major fruits account for 65 per cent of the fruit total.

China dominates the industry and is responsible for over a third of total global fruit and veg production. In particular China’s vegetable production growth is nothing short of spectacular at 240 per cent over the last decade: nowadays half of the world’s vegetables are grown in China. Four countries - China, India, the US and Turkey - are jointly responsible for two-thirds of global vegetable production. China has also replaced India and Brazil as the world’s largest producer of fruit, accounting for 15 per cent of global fruit production.

Calculations reveal that nowadays one to two per cent of global fruit and veg acreage is cultivated under some sort of cover, which leaves the majority of fruits and vegetables grown in open fields. Covered cultivation of crops, vegetables in particular, has contributed to higher yields, but also higher quality crops and the possibility for seasonal extension, sometimes even year-round production. China’s growth in vegetable production is strongly linked to the use of covers, especially plastic tunnels. Covered production is likely to increase in the future.

In general, fruit and vegetables are labour intensive crops grown by many millions of small growers as well as large commercial plantations (in particular banana and citrus). Improved inputs in combination with improved agricultural equipment, cultivation and harvesting techniques are major contributors to global production growth. A considerable share of production involves home-grown production for own consumption or sale to the local community. However, more and more produce is grown commercially, with a trend towards larger, specialised farms.

The perishable nature of fresh produce is an issue. The shelf life of some fresh produce can be increased by storing it under climate-controlled conditions, however processing of produce provides a more firm answer to increased shelf life. It enables producers to store their products for longer periods and distribute over longer distances without the need for expensive climate controlled conditions.

Also, from a consumer perspective processed fruit and veg have certain advantages over fresh products; not only can products be kept longer in the cupboard but they generally require less preparation for consumption.

Pre-cutting is a form of processing as well, fulfilling demand for convenience. New processing techniques enable processors to maintain most of the products healthy aspects.

In its ongoing search for the best way of preserving fruit and veg, the processing industry is now searching for added value products that appeal to the consumer’s desire for fresh and healthy yet convenient, solutions.

Examples are fresh pre-cut fruit and veg, possibly in the form of a meal component or a meal. Both new processing and packaging technology enable fresh products to be presented in a convenient format (e.g. pre-cut or pre-cooked) while maintaining aspects of health and freshness. Positive developments are expected in the category of deep frozen products, which maintain not only original levels of nutritional value but can be kept for longer periods.

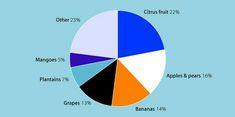

In contrast to production, trade is more dominant in fruit compared to vegetables; fruit accounts for about 60 per cent of total trade and vegetables 40 per cent. Bananas are by far the world’s most traded fruit accounting for over a third of global fruit trade.

Bananas together with citrus, apples and pears account for 75 per cent of global fruit trade. Over the last decade no major shifts have taken place in the type of traded fruits, though there is a slight rise in trade of tropical fruits such as mangoes and avocados. The EU accounts for nearly half of the world’s imports of fruit, which makes the EU the world’s largest fruit importer.

In contrast to fruit, the trade of vegetables is more regional and mainly concerns tomatoes and onions. In the last decade China has become a more dominant player in the exports of vegetables (mainly to Japan), in contrast to exports from the EU, which have decreased. In that same time span, the US has shifted from a net exporter to a net importer of vegetables, in which Mexico serves as a major supplier. Japan remains a major net importer for both vegetables and fruits.

The vast majority of fruit and veg are still consumed close to the place of production; global trade of fresh produce accounts for just over five per cent of global production. Current volumes of trading amount to 70 million tonnes and has grown by half over the last decade, more rapidly than any other agricultural commodity.

A large share of fruit and veg trade concerns fruit which is traded from the southern to the northern hemisphere in order to provide the consumer with fresh produce year-round.

Over time, increasingly sophisticated supply chains have provided the consumer with a wide choice of produce, available year-round, in different grades and often with organic alternatives. Retailers try to cater as much as possible to consumers’ desire for fresh, tasty and high quality produce. Moreover, as consumers tend to spend less and less time preparing a meal, they want convenience.

Fresh-cut fruit and veg and clever meal solutions, either fresh or processed, are the desired alternatives for unprocessed produce. In particular, snacking habits have inspired companies to provide on-the-go solutions.

Assortments, quality levels (including food safety) and availability of fresh produce will keep on growing. However, consumer preferences for specific types of fruits and vegetables will only change gradually.

Often the consumer has a preference for a fixed basket of fruit and vegetables, complemented with a variable basket where tropical fruits alternate with local seasonal fruits.

Changes in the way fruit and veg is presented to the consumer will become more visible, including different packaging, pre-cut, single-portioned and organic alternatives.