European greenhouse growers need to rethink the structure of their company and the value chains within which they operate. A strong organisation is instrumental in adapting to market developments and in coping with rivalry.

Currently, the European greenhouse sector is extremely diverse, dominated by over 100,000 small-scale, mainly family-owned businesses, with only a few large growers with tens of hectares of greenhouses.

Characteristic of the overall greenhouse sector is the volatility in revenues. For individual businesses, it is difficult to influence key market drivers such as areas planted, weather circumstances, exchange rates, and energy prices.

Nonetheless, growers do not have to stand by and watch. They can take more control by reinforcing their company and value-chain structure.

Stronger together

The structure of the future greenhouse sector is expected to remain diverse, with different supply-chain models and business structures thriving next to each other.

But the emergence of forward-integrated sizeable growers or growers collectives is unstoppable. Scale, either organised within one company or collectively among various growers, makes sense for various reasons. What this does is:

• Better supplies what the market demands instead of what supply offers

• Creates more opportunities for marketing and adding value to products (by packaging, cutting, selling combinations with other products, etc)

• Helps to make decisions based on data (such as retail-shopper data)

• Obtains access to (human) capital in order to implement new technology, produce new varieties, and invest in sustainable production (environment, food safety, etc)

• Generates a more stable cash flow

• Diversifies risks

• Passes the company on to successors.

• Prevents destructive competition

Three business structures evolve

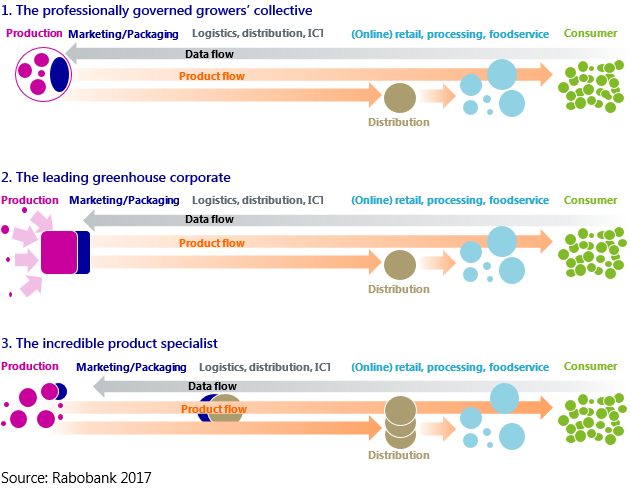

In the next decade, Rabobank sees three dominant business and supply-chain structures evolving in the production of greenhouse vegetables:

1. The professionally-governed grower collective

This is a group of producers that make use of joint production planning and professional governance (thus not necessarily the growers involved). Ownership of land and buildings is still with the grower members, but the business is run together.

By using more centralised marketing and production planning, growers can fine-tune production capacity with expected demand. In this structure, growers cannot expand production if the collective does not foresee any demand for it.

This grower collective is sizeable enough to supply an attractive year-round range of greenhouse vegetables directly (or via a distributor or logistics service provider) to retail and foodservice customers.

The main differences with most of the current cooperatives include more professional governance, a higher degree of mutual trust to share production capacity, demand-driven production planning, and closer interaction with final (retail and foodservice) customers.

2. The corporate greenhouse grower

The corporate greenhouse company does not yet exist in Europe, although some players already bear some marks of a corporate greenhouse. A North American example of a corporate greenhouse grower is Sunset (Mastronardi Produce).

Few large European greenhouse players, likely with help from investors, will further consolidate into corporates.

Corporate growers will combine different product sources to supply a full range of the main greenhouse vegetables (or one specific vegetable) all year-round—from their own local production, locations abroad, contracted growers, and imports.

Ownership of a greenhouse corporate is with one or several shareholders, such as the families who started the business, investors, and/or key employees.

For successful grower collectives, it is also an option to turn the joint business into a single company and become shareholders of a greenhouse corporate.

3. The incredible product specialist

Product specialists are growers, both small and large, who are successful with a unique or premium product. These can be organic vegetables or niche products such as chili peppers, rare-coloured aubergines, cresses, premium fresh herbs, or aromatic plants such as vanilla.

These products continue to be supplied via various supply chains, via cooperatives, in cooperation with greenhouse corporates, direct-to-consumer online, or via traditional wholesale channels.

Building resilient greenhouse businesses

Rabobank is positive about the future of the European greenhouse sector if growers come into power. Growers have the chance to take advantage of the abundant market opportunities without ending up in devastating competition. New company structures with collective business models or even shared ownership can create companies that are attractive partners for (large) customers, and can result in more stable cash flows and reduced risks.

This is the third article in a series of articles on the European greenhouse sector.Part one can be found hereand part two can be found here.These articles are largely based on a recently published Dutch-language report on the Dutch Greenhouse Sector,De Nederlandse glasgroentesector naar voren: Bouwen aan een robuuste onderneming in 2026.