Wayne Prowse explains how the country’s commitment to certain categories makes it a key counter-seasonal supplier

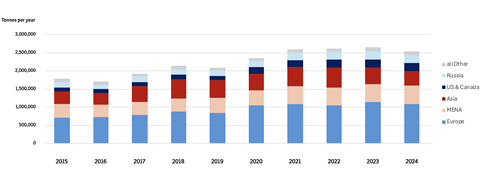

Located at the foot of the African continent, thousands of miles from key markets, South Africa’s largely temperate climate and fertile river valleys have enabled it to become a major producer of fruits that can meet counter-seasonal demand in the Northern Hemisphere.

The country has long been Europe’s out-of-season fruit bowl and its focus on exports is strong: each year, foreign markets take around 62 per cent of its 6.8mn tonnes of fresh fruit production.

South Africa is the largest citrus exporter in the Southern Hemisphere, and the second-largest in the world after Spain. But it offers more than citrus: South Africa is also a large exporter of apples, pears and table grapes, and increasingly stonefruit, avocados and blueberries.

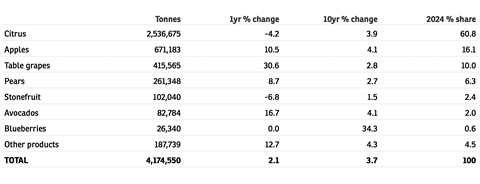

In 2024, the nation’s fresh fruit exports were up 2.1 per cent to 4.2mn tonnes, a trend influenced by strong increases in apples, grapes and avocados. The ten-year trend for fresh fruit exports is +3.7 per cent per year (CAGR).

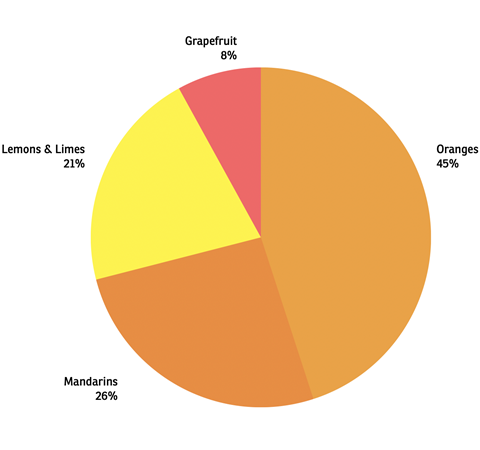

Citrus

Citrus accounts for 61 per cent of South Africa’s fresh fruit exports. In 2024, it exported 2.5mn tonnes of citrus, which was 4.5 per cent lower year on year and broke a long-running period of growth. Unusual weather events, including floods in the Western Cape and a frost in Limpopo, affected Navel orange exports – although volumes are expected to improve again in 2025 in line with the five-year average, according to the Citrus Growers Association.

Europe, Middle East and Asia are the main destination markets. Trade to Europe accounts for the lion share, with around 43 per cent of that export trade.

While oranges have been the mainstay of the citrus exports, changing tastes and demand for soft citrus have seen stronger growth in mandarins over the past decade. In the meantime, orange exports have been steady at around 1.1mn tonnes. Mandarins have increased 17 per cent per year over the past decade and now account for 25 per cent of citrus exports, followed by lemons with a 21 per cent share.

Apples

Apple exports are setting new record levels. In 2024, they increased 10 per cent to 671,183 tonnes, pushing up the ten-year average annual growth rate to 4.1 per cent (CAGR). This growth has been influenced by an expansion of production in recently planted orchards, by higher-yielding varieties, and better weather conditions, according to industry body Hortgro. Royal Gala and Pink Lady are the main varieties grown for export.

South Africa exports almost 40 per cent of its apples to other countries on the African continent, including Nigeria, Senegal and Kenya. Collectively, this intercontinental trade has increased steadily by around 2 per cent per year over the past ten years.

Asian markets including India, Vietnam and China account for almost 30 per cent of South African apple exports, and are among the faster-growing destinations. Trade to India, for example, has lifted from below 1,000 tonnes to 38,000 tonnes over the last decade, and similar growth has been recorded in Vietnam, which recently took 28,000 tonnes. Middle East markets, including United Arab Emirates, have increased their imports by 10 per cent per year over the decade, and now account for 10 per cent of exports.

Trade to Europe, which includes the UK as South Africa’s single largest destination for apples, has improved marginally at 2 per cent per year over the ten years. Fluctuations in European supply have made this trade more unpredictable, but demand for South African fruit has been strong in periods of lower European production.

Grapes

Table grape exports also reached a record level in 2024, at 415,565 tonnes. That was 30 per cent up on the year, and a return to the long-term growth trajectory of 2.8 per cent per year.

Over 75 per cent of South Africa’s table grapes are destined for Europe, where they maintain a strong counter-seasonal advantage. That trade lifted 35 per cent in 2024, following adverse rainfall in the Hex River region late in the previous season.

Asia, Africa, Middle East and North American markets account for around 5 per cent each, with Canada the stand-out growth market – up 85 per cent last year and 24 per cent per year over the decade, to reach 24,000 tonnes. Exports to Asian markets have fallen 3.7 per cent per year, as South Africa faces more competition from other Southern Hemisphere suppliers.

Pears

Exports of South African pears increased 2.7 per cent per year over the ten years to a near record 261,348 tonnes, and by almost 9 per cent in 2024 alone. Europe is the main destination, and accounts for 36 per cent of exports, followed by Asian markets with a 20 per cent share.

Demand for South African pears in Europe varies according to the size of the European crop and the need to import from the Southern Hemisphere. Trade to Europe rose 20 per cent in 2024, influenced by record-low European production in 2023. But this reduced South Africa’s ability to supply to Asia – mostly India – by 7 per cent.

Stonefruit

Over the longer term, stonefruit exports – peaches, nectarines, plums and apricots – have increased 1.5 per cent per year to 102,040 tonnes. But that figure is down from a 131,000-tonne peak in 2022. Plums make up the largest category at 68 per cent, followed by peaches and nectarines with 28 per cent, and apricots with 4 per cent.

European markets are the main destination, accounting for 64 per cent of exports. 16 per cent were exported to the Middle East. Although Asia only takes 4 per cent, there are growth opportunities in the region as several markets grant South African trade access.

Last year, the country’s stonefruit exports decreased by 6.8 per cent, a result that was partially influenced by adverse weather conditions in some areas, which affected flowering and fruit set. However, these results are set to improve as the season runs into 2025, with exports increasing again to the longer-term trajectory.

Avocados

South Africa is a significant exporter of avocados to European markets. Avocado exports have increased 4.1 per cent per year over the decade to reach 82,784 tonnes in 2024, with 87 per cent destined for European markets. The remaining volumes are exported to Middle East, Asia and other African markets.