Wayne Prowse highlights the country’s new success in tropical products like mangoes, dragon fruit, pineapples and avocados

Ecuador, the world’s largest banana exporter is looking to newer products in the fruit business for growth.

The Latin American country is a very much an export-focused supplier of tropical fruit – shipments abroad account for around 70 per cent of the country’s 9.4mn tonnes of fresh fruit production.

To its advantage, this small, equatorial country on the north-west edge of South America known for its exceptional biodiversity and tropical ecosystems, and as such is home to a wide range of tropical fruits.

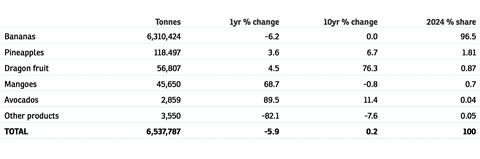

While bananas account for 96.5 per cent of the country’s 6.54mn tonnes of fresh fruit exports, the ten-year trend for this category is flat.

In the meantime, higher sales of dragon fruit, pineapples and avocados are contributing to growth from a small base.

In 2024, Ecuador’s fresh fruit exports dropped 5.9 per cent. That trend was influenced by what happened in bananas, but at the same time more of the country’s line-up of newer tropical products were exported.

Bananas

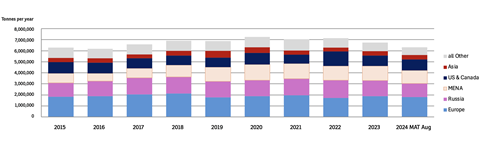

Bananas dominate Ecuador’s fresh fruit offer, and account for a 96.5 per cent volume share of exports – of which 29 per cent, or 1.8 mn tonnes, are shipped to markets in Europe, and 19 per cent each to Russia and the MENA region. The US and Canada take 16 per cent of Ecuador’s bananas, while 6 per cent or 380,000 tonnes are exported to Asian markets.

Banana export volumes dropped 6 per cent year on year to 6.3 mn tonnes worth US$ 3.76bn in 2024. Ecuador’s banana volume growth trend rose to a peak of 7.2mn tonnes in 2020, but has since declined 13 per cent in four years.

Ecuador now accounts for around 28 per cent of the global banana trade, and remains the world’s largest exporter of the fruit.

Pineapples

The past ten years have seen a resurgence in Ecuador’s pineapple export trade, with a CAGR of 7 per cent per year. The fruit now accounts for 1.8 per cent of the country’s total fruit exports.

In 2024, pineapple sales to foreign markets were up 4 per cent to 118,497 tonnes, with around 43 per cent destined for Europe. Around 27 per cent of the country’s pineapple exports are sent to the US, which has gone from importing less than 1,000 tones in 2018 to 32,000 tonnes in 2024.

Ecuador’s is the world’s third-largest supplier of pineapples after Costa Rica and Philippines, and its exports account for around 7 per cent of the global pineapple trade. In South America itself, Chile is the largest market for Ecuadorian pineapples.

Dragon fruit

Dragon fruit, also known as pitaya or pitahaya, is an emerging export item in Ecuador. The country only began to ship it overseas ten years ago, but in 2024 it exported 56,807 tonnes of the fruit. Its main destination for dragon fruit is the US, which accounts for 60 per cent of exports, followed by Peru with small volumes. Demand is said to be increasing in both Europe and Asia.

Mangoes

Ecuador’s mango exports were up by almost 70 per cent year on year to 46,000 tonnes in 2024, after its crop recovered from the impact of El Niño in 2023. Over the ten years to 2023, exports traditionally held at around 50,000 to 60,000 tonnes per year. Almost all of Ecuador’s mango exports are sent to the US, where the country is the second-largest supplier after Mexico.

Avocados

Rounding out Ecuador’s top five, its expanding avocado exports might be negligible in terms of global trade in the product, but that volume has increased 89 per cent year on year to 2,859 tonnes. Almost all of its avocado exports went to Europe, either directly or via neighbouring Colombia.