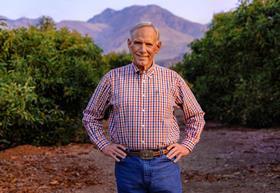

Mission Produce chief executive Steve Barnard said the company was disappointed with its financial performance over the fiscal first quarter (Q1) of 2022 (ending 31 January2022).

The California-based company posted a net loss of US$13.4m over the period. It returned a net profit of US$2.2m over the corresponding period a year earlier.

Adjusted EBITDA came in at US$10.4m during fiscal Q1 2022, compared to US$12.5m in 2021.

Mission’s total revenue of US$216.6m for the quarter was up 25 per cent year-on-year. This growth was driven by a 50 per cent increase in average per-unit avocado sales prices, due to lower industry supply out of Mexico, as well as inflationary pressures.

Partially offsetting price gains was an 18 per cent decrease in avocado volume sold, which was primarily driven by lower supply, but exacerbated by price sensitivity in some international markets.

Barnard said the results were also negatively impacted by inflated transportation rates.

These challenges were amplified by implementation issues with the group’s enterprise resource planning (ERP) system, which Barnard said prevented a quick response to the issues.

“We are disappointed in our fiscal first-quarter performance where we experienced greater than anticipated operational challenges associated with our ERP system conversion on 1 November, 2021,” Barnard explained.

“The ERP implementation caused certain operational issues that temporarily limited our ability to manage our business and operations efficiently and eroded our ability to drive the per-unit margins that we have historically generated.

“While this was a difficult transition, it was a necessary infrastructure upgrade to ensure that we have the systems and capabilities in place to manage our ever-growing global presence – in terms of new sources of supply and our expanding global customer base– for many years to come.”

Despite the ERP implementation challenges, Barnard said Mission was able to fulfill customer commitments in both its core avocado business and its developing mangoes division.

“Not only did we retain all our customers during the quarter, but we were able to gain two additional significant customers who will represent meaningful additional volume for the business in the future,” Barnard explained.

“We are confident in our ability to execute on our strategic growth plans as we continue to put the challenges we faced with the implementation behind us.”

Based on industry updates, Mission expects second quarter avocado volumes out of Mexico to remain lower than the previous year by “amounts comparable to those experienced in the first quarter of 2022”. This is primarily due to supply constraints associated with the Mexican harvest.

Avocado pricing is expected to be slightly higher on a sequential basis.

“February per-box margins have returned to historical levels, though we are still experiencing higher non-ERP related costs, including inflationary and infrastructure costs, that will continue to pose some headwinds over the near-term,” according to a statement from Mission.