Diego Paredes, founder of EcuaBlue, tells Fruitnet how the country’s burgeoning blueberry industry has big ambitions

Blueberry sales are booming in Ecuador. Thanks to its nutritional benefits, the fruit is highly prized among consumers and it can sell for up to US$10 per kg on the local market. EcuaBlue has been at the forefront of the sector’s development since it was established in 2018. Its goal is to become a leading producer of premium blueberry varieties for the national and international market.

Diego, tell us about the progress Ecuador has made on its blueberry export journey over the past few years.

Diego Paredes: EcuaBlue began operations in 2018 testing free-range blueberry varieties such as Biloxi in the Ecuadorian Sierra, at an altitude of 2,500m. Thanks to the excellent results we achieved in both fruit quality and yield, we decided to implement the best that the blueberry industry has to offer.

We looked at the best practices developed in Mexico, Peru and Chile and put together a technological package for blueberry cultivation in Ecuador, focusing not on what has worked up to now, but rather what we think will work in the future.

We have defined three fundamental pillars for cultivation: genetics, water and substrate, and we’ve contacted the best in the industry in order to get advice on each.

Today we are the Ecuadorean representative of some of the best companies involved in blueberry production. We offer producers advice and technological packages drawn from all over the world.

We manage the genetics of Mountain Blue Genetics from Australia, CocoGreen substrate from the UK, Pasquini & Bini Pots from Italy and the Responsive Drip Irrigation RDI irrigation system from the US.

By teaming up with these strategic partners, who have experience across five continents with some of the biggest growers in the business, we have managed to shorten the learning curve here in Ecuador, avoiding mistakes that can be very costly.

What are the main factors driving the growth of the blueberry industry in Ecuador today?

DP: Initially it was being driven by how profitable blueberries are – today the average sale price per kg in Ecuador is far higher than the global average, which makes the domestic market extremely attractive for farmers. It is evident that this price will not last long, the Ecuadorean market is very small, and in a short time it will be saturated. That is when we must ensure we have enough fruit to be able to start exporting.

The next factor is the quality of the blueberries produced in Ecuador. We are already known for the excellent quality of our bananas, cocoa, roses and broccoli, and very soon we will also be known for our great blueberries. We’re also able to produce throughout the year, enabling us to supply premium market niches that demand the best quality on a weekly basis. It is clear that we will not be the biggest producers in terms of volume but we aim to be the one with the highest quality.

It must be understood that the global blueberry market went from being supply driven (until a few years ago those who had blueberries sold their production without any problem at very good prices) to being demand-led, that is to say that since there is a supply throughout the year of different origins, customers are looking for a pleasant and consistent eating experience. They are already familiar with the fruit, now they want the best fruit, and the basis of supplying this is genetics. That is why Mountain Blue Genetics was our first choice to produce the best high altitude blueberry in Ecuador for 52 weeks of the year.

Is the Ecuadorean blueberry industry attracting investment from other countries?

DP: The bulk of investment has come from Ecuadorean capital, but there are also foreign players, such as Chile, that are already present in our country. ^

I understand that tests are being carried out in various parts of the country to see where the growing conditions are best suited to blueberries. Which areas are showing the most promise?

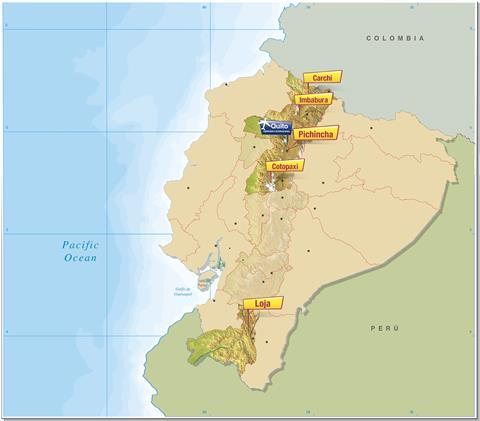

DP: There are currently around 80ha of blueberry plantings in Ecuador growing 14 different varieties, most of them in the Ecuadorean Sierra between 1,500m and 2,900m above sea level. Provinces such as Pichincha, Cotopaxi, Imbabura, Carchi and Loja are among the most promising so far. But we’re still in the initial stage of testing, adapting and learning.

When do you expect the first exports of Ecuadorean-grown blueberries to get underway?

DP: There has already been a number of trial shipments to the Netherlands, which have been well received. But the domestic market is still more attractive – not to say easier to navigate. Eventually, as production increases, local prices will become less attractaive and this will force the producer to focus on exports. We must prepare ourselves so that when this time comes, we are in a position to reach the market with the best possible quality of fruit. I would say our natural markets are the US and Europe.

Looking ahead, how do you think the sector will evolve over the next few years?

DP: We’re hoping to get government support to promote the production of blueberries and other non-traditional crops. We also need to improve labour laws by making hiring more flexible – and, of course, we need to open up new export markets, such as China.

In the medium term we hope to reach 1,000ha of blueberry cultivation focused on the best genetics available today, something that will allow us to differentiate our offer from that of our neighbours.