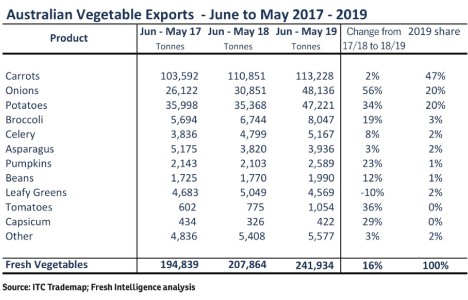

Australian fresh vegetable exports increased 16 per cent to 242,000 tonnes over the 12 months to 31 May 2019 (2018/19), according to Australian Bureau of Statistics (ABS) data. The trade was valued at A$299m.

Onions have been a major growth driver, with export volumes increasing 56 per cent year-on-year to 48,000 tonnes over 2018/19. Onion exports to Europe alone increased from 8,066 tonnes in 2017/18 (12 months to 31 May 2018) to 17,845 tonnes in 2018/19, with most of these shipments coming from Tasmania. The European onion harvest was lighter in 2018 and has led to a shortage, resulting in strong demand for Australian and New Zealand-grown product to fill the gap. New Zealand onion exports to Europe were up 49 per cent year-on-year at 104,000 tonnes over the denoted 2018/19 period.

Potatoes were another growth driver, with exports up 34 per cent year-on-year to 47,000 tonnes. Almost 6,000 tonnes of fresh potatoes were sent to Thailand for processing, marking the first trade since 2013. South Korea is Australia’s main fresh potato export market, taking around 18,000 tonnes over 2018/19, while the Philippines took 4,500 tonnes, similar levels to the previous year.

Carrots accounted for 47 per cent of all fresh vegetables exported from Australia over 2018/19. The carrot trade rose by 2 per cent to 113,000 tonnes, with Middle East markets, including the UAE, Saudi Arabia and Kuwait, the main destinations. Carrot exports to Japan increased 34 per cent to 3,600 tonnes. Japan’s overall carrot import trade (all sources) lifted 25 per cent to 120,000 tonnes over 2018/19.

Growth among the remaining Australian vegetable exports included broccoli (up 19 per cent to 8,047 tonnes), pumpkins (up 23 per cent to 2,589 tonnes) and tomatoes (up 36 per cent to 1,054 tonnes).

Asparagus exports lifted 3 per cent to 3,936 tonnes, mostly to Japan, stemming a rapid fall from above 5,000 tonnes in 2016/17.

Cabbages, lettuce and other leafy greens were the only vegetable sectors to dip over 2018/19, after a few years of strong growth. These higher value lines service niche markets in Asia, particularly Singapore, and compete with leafy green vegetables in abundant supply from China and other Asian markets.