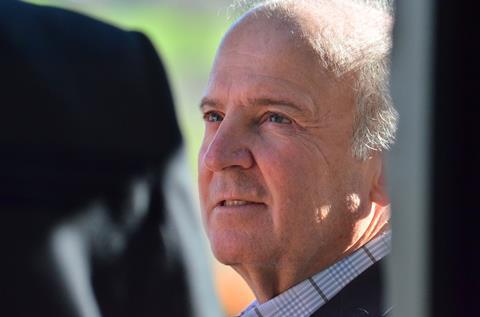

CEO David Marguleas discusses what the company’s acquisition of Biogold will mean for growers, retailers and consumers

David, the Biogold deal marks a significant expansion of Sun World’s portfolio with inclusion of citrus and subtropicals. These are products that were already on your radar – in 2021, Sun World hired breeder Moises Gonzalez to begin new breeding programmes in citrus, mango and avocado. What opportunities do you see in these categories?

DM: We’ve been successfully developing new varieties of table grapes and stonefruit for many years and wanted to identify crops that were underserved in the breeding world, both at the public level with government and university breeding programmes, as well as in the private sector.

We identified a few crops that, despite being major economic drivers in the fruit industry, didn’t attract quite as much attention in the breeding and research sector, those being citrus, avocado and mangoes. They are often grown in close proximity with table grapes and stonefruit, and we felt that with our own expertise in bringing new varieties to the marketplace, we could make a difference in these categories, particularly in citrus and mangoes.

What about avocados? Given that Hass accounts for the bulk of the global trade, where do you see the opportunities in this category?

DM: Biogold holds the rights to one of the largest collections of avocado varieties and germplasm in the world and we’re hopeful that its collection will result in some new varieties that will resemble Hass, but improve upon its seasonality, shelf-life and eating quality.

What timescale are we looking at in terms of commercial launch of these varieties?

DM: I think the nearest term opportunities for us resulting from the Biogold acquisition are in the mango category. Citrus breeding programme would be next – I would call that mid-term, maybe three to five years. Avocados would be a little further out, perhaps five to ten years.

So can we expect to see some new mango varieties hit the market in the next couple of years?

DM: Yes, I believe the combination of a variety that Sun World owns, some of the initial work that Moises Gonzalez has been doing in the mango area, and a number of potentially commercial varieties that come with the Biogold acquisition should enable us to make some introductions in the next couple of years.

Mangoes are one of the most widely consumed fruits in the world, but there has not been a tremendous amount of innovation in the category, which is why we think there’s a huge opportunity here.

What are the specific characteristics that you are focusing on when it comes to the development of new mango varieties?

DM: A lower fibre content, thinner seed, more edible fruit, more vibrant exterior blush and that creamy flavour that people appreciate in a number of mango varieties that are grown round the world. There are also several diseases that impact mango production, so we’re looking at a number of disease resistance traits and climate resilient traits that will enable growers to withstand some of the drought conditions and wild variations in temperatures that we’ve all experienced in recent years.

Are you planning to go down the same route as with table grapes in terms of developing consumer branding for your new varietal launches?

DM: We certainly think there are opportunities to develop consumer brands for a number of varieties that we’ll be introducing in the coming years, much as we’ve been doing in table grapes with Autumncrisp and Ruby Rush, and with our red-fleshed Black Diamond plum line. So yes, branding will be an important part of those introductions.

In citrus, you say you want to develop specialiity varieties. Which specific products are you focusing on?

DM: One of the main focal points for Biogold has been around easy peelers, in particular mandarins. This has been one of the few growth areas in the citrus category post-Covid. We are excited about continuing the work that Biogold has done with a number of public and private breeders in this area. There are opportunities to extend the season to both precede and follow popular varieties like Nadorcott and Tango, and to introduce truly seedless versions of easy-peel mandarins.

The other category that we see a lot promise in is the lemon category, which has been relatively stagnant in recent years. We’ve very encouraged by the growth in the seedless lemon category, and in particular there are several varieties that Biogold manages for third-party breeders that have met with a great deal of success in North America as well as in Europe.

The third area we’re looking at is red pigmented mandarins and oranges. We see great opportunities based on the varieties that we’ve been evaluating that Biogold has been working with in recent years.

There’s a fourth category that I wouldn’t assign quite the same importance to but that we feel has some potential, and that is the grapefruit category. This has been fairly anaemic over the last 20-30 years as the use of statins has discouraged people from eating a lot of grapefruit and the tartness of the fruit hasn’t appealed to younger consumers.

Biogold is evaluating several grapefruit varieties with lower acid content and higher brix, and with a deeper red pigmentation both in the flesh and on the skin. We’re hoping to revive the grapefruit category with some of these characteristics.

What about disease resistance – is this also an integral part of your citrus breeding efforts?

DM: Sustainability has been critical to Sun World in the grape and stonefruit categories and it’s just as important in the citrus and subtropicals categories. We’ve been working on resistance and tolerance to both diseases and pests, as well as climate resilience. HLBis a major concern to citrus growers globally and many of the public and private breeders that Biogold represents have been doing some meaningful work in this area.

With the development of new technologies like AI and genetics, breeding has essentially become a numbers game – the bigger your germplasm collection, the faster you can get new varieties to market. Do you think the current wave of consolidation in the sector will intensify?

DM: There’s no question that we’ve made meaningful progress in science and technology as a fruit breeder and now we can apply some of those learnings to citrus and subtropicals, along with table grapes and stonefruit.

The use of new technologies like molecular breeding to build on the four decades of work that we’ve been doing around plant breeding should position us in a positive way with retailers and consumers that are looking for varieties with new traits.

To give you an example, traits such as disease and pest resistance and climate resilience should enable us to develop new varieties that can be grown in non-traditional areas. In cherries we’ve been working on a line that is more resistant to higher temperatures and can be grown in non-traditional areas on the shoulders of the season, when supply is lowest. Similarly, the ability to produce new citrus varieties in more drought-like or warmer conditions where citrus would not traditionally thrive is another area where we’ve been trying to use technology.

Things like AI and predictive analytics and molecular breeding are important tools in our toolbox. Coupled with the 45 years of conventional breeding that we’ve done, this gives us lots of hope.

How has Sun World positioned itself to take full advantage of these technological advances?

DM: In addition to the varieties that Biogold brings to Sun World there are also several dozen people that have been working at Biogold around the world in many of the same locations as our own team members in the major fruit growing regions, so we’re particularly excited about bringing the two companies together, in particular the two cultures of the business.

The other exciting change that has been underway at Sun World in recent years is bringing on a more robust management team to help introduce a lot of these new varieties to growers and retailers around the world. We’ve been staffing up our management and leadership teams and we’ve had the privilege of bringing in a number of high-profile board members, who have particular expertise in fields like AI, the breeding of speciality crops.

For example, Dr Elliot Grant, is an expert in AI who used to run one of Google’s portfolio of companies in the horticultural space. And Sebastian Langbehn is one of our directors who came from Monsanto and Bayer in the speciality vegetable world. And then there is former Secretary of Agriculture Anne Veneman, who has also come on board as an independent director. Those three have been invaluable advisors to me and the rest of the executive team.

What about the grower – is there concern among the grower community that the consolidation we’re seeing in breeding could exert commercial pressure on them?

DM: The initial reaction from the grower community to the Biogold deal has been overwhelmingly positive. We spent the last week with over 300 producers [at Sun World’s table grape field days in Bakersfield, California] and we continue to hear lots of enthusiasm for bringing them more innovation across the horticultural industry. For many years now, our table grape growers have been asking us to get involved in other products like citrus and mangoes. Last week during our field days that interest started to become a reality as we began discussions with a number of large table grape growers that are also eager to plant new citrus and mango varieties – particularly in countries where those crops are grown adjacent to one another. These are growers that have been reluctant to plant mandarins or mangoes because of the dearth of innovation in this area.

What’s next? Are you planning to add more products to your breeding portfolio?

DM: Our initial focus is to build out the cherry, mango, citrus and grape programmes that we have, and to continue to look for partners that enable us to offer growers innovation and more sustainability in their businesses. So you can expect to see extensions of existing grape lines with varieties that resemble Autumncrisp, that precede and follow it in the marketplace, as well as the cherry lines that I mentioned, and then mangoes, which are probably one of our more near-term development opportunities given the size and success of the Biogold mango breeding programme.

Biogold is primarily a varietal rights management company that represents third party breeders. We have been fielding several enquiries from other breeders that are looking to have us help them commercialise their lines. That’s one area of opportunity.

The other is to find complementary crops that are underserved in the marketplace where we can be of help.